Advocacy

Fairview is committed to supporting residents through long-term advocacy work. Thanks to a team of affordable housing and policy advocacy experts, the organization is able to advocate for the industry’s mission in a variety of ways, from background research about issues in affordable housing to direct support of policy that will benefit residents.

It’s Time We Renovate Regulations to Solve the Housing Crisis

Decades of overlapping federal, state, and local regulations have slowed affordable housing production and driven up costs. Streamlined reforms, paired with legislative action, supply chain improvements, and local land-use changes, could help accelerate development and address the nation’s housing shortage.

Setting Up for Success: the New 25% Financed-By Test for 4% LIHTC-Bond Transactions

Recent changes to federal tax credit policy could significantly increase the supply of affordable rental housing. The One Big Beautiful Bill Act lowers the bond financing requirement for 4% LIHTC developments from 50% to 25%, creating new opportunities to expand production. This article outlines key considerations for stakeholders to ensure the policy delivers on its potential, including efficient bond allocation, simplification of state housing policies, and prioritization of developments that can scale quickly and cost-effectively. With coordinated action, this policy shift can help address the nation’s deepening housing shortage.

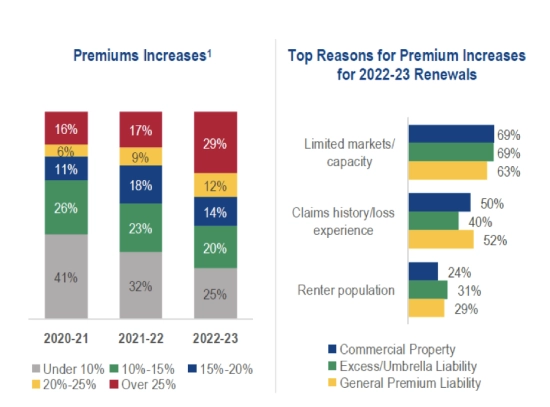

Dealbreaker: The Imminent Threat of Rising Insurance Costs

In Texas and across the nation, affordable housing developers and operators are facing a growing crisis, and it’s not just construction costs or workforce shortages. It’s insurance.

Homeowners Insurance: The Other Affordability Crisis

The wildfires that swept through two Los Angeles neighborhoods in January 2025 destroyed 11,434 homes valued at nearly $30 billion. Less than two years earlier, a wildfire that took out most of Lahaina Town on the Hawaiian island of Maui leveled 1,500 homes valued at about $6 billion. And in October of last year, flooding from Hurricane Helene demolished 1,000 homes and severally damaged another 74,000, mostly in western North Carolina, resulting in an estimated $12 billion for replacement and repair costs.

Developing a Preservation Risk Mitigation Methodology

The United States is facing an affordable housing crisis. The 2024 State of the Nation’s Housing Report found that homeowners and renters are struggling with high housing costs, and that the number of cost burdened renters is at an all-time high. To solve the affordable housing crisis, policy makers must take action to increase housing supply and take concerted action to preserve the nation’s existing affordable housing stock. This paper explores factors stakeholders should evaluate when prioritizing effective and cost-efficient policy interventions that maximize the preservation of highest impact affordable housing communities. Key topics explored include housing market conditions, availability of financial resources, affordability terms, physical and financial conditions and ownership characteristics.

Impediments in the Insurance Marketplace for Affordable Housing

Affordable housing developers, owners and operators are experiencing unprecedented challenges relating to increased property casualty, general liability, and builders risk insurance premiums. If not addressed soon, insurance premium inflation will cause irreparable harm to existing affordable housing communities and prevent the ability of developers to finance desperately needed new affordable housing supply. This paper explores the market dynamics driving insurance inflation, its impact on housing affordability and housing production and federal policy solutions that could provide affordable housing operators and developers with more available, affordable and attainable insurance coverage

State and Local Policy Strategies to Address the Affordable Housing Insurance Crisis